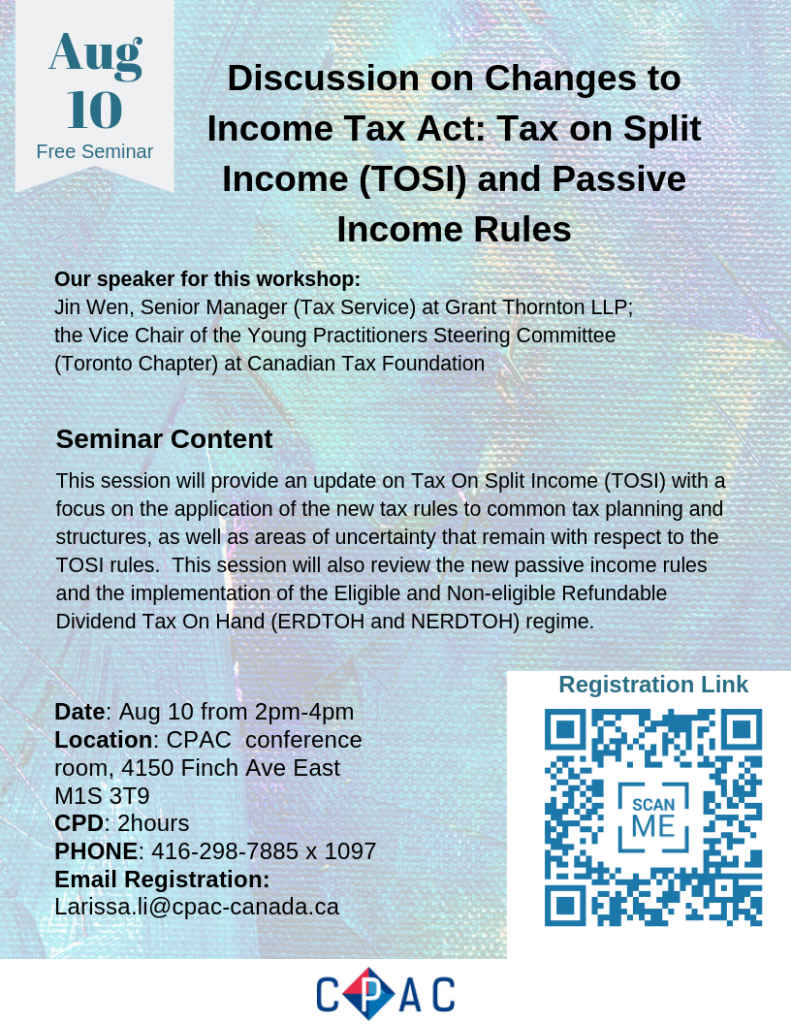

Aug 10 Discussion on Changes to Income Tax Act: Tax on Split Income (TOSI) and Passive Income Rules

This session will provide an update on Tax On Split Income (TOSI) with a focus on the application of the new tax rules to common tax planning and structures, as well as areas of uncertainty that remain with respect to the TOSI rules. This session will also review the new passive income rules and the implementation of the Eligible and Non-eligible Refundable Dividend Tax On Hand (ERDTOH and NERDTOH) regime.

Our speaker for this workshop:

Jin Wen, Senior Manager (Tax Service) at Grant Thornton LLP;

the Vice Chair of the Young Practitioners Steering Committee (Toronto Chapter) at Canadian Tax Foundation

Date: Aug 10 from 2pm-4pm

Location: CPAC conference room, 4150 Finch Ave East M1S 3T9

CPD: 2hours

PHONE: 416-298-7885 x 1097

Email Registration: Larissa.li@cpac-canada.ca

Online Registration Link: https://forms.gle/8ppsTg6oifsa9o7q8